INTRODUCING FINANCIAL CARE

Financial Care is more than financial wellness.

With clear incentives to take responsibility for employees’ financial health, what is stopping employers from doing so? To date, it’s been the complete lack of safe and effective options.

Financial Care Drives Real ROI

Retention

When employees love their benefits, they want to stick around. Employees who engage with Brightside are 41% less likely to leave, according to our research. Imagine the impact: SHRM estimates the cost of replacing an employee to be over 50% of their salary!

Healthcare Costs

Financial strain is the single most important factor in making healthcare decisions for low-income individuals. In fact, if financially strained individuals utilized healthcare at the rate of the most affluent, overall spending could decrease by as much as 30%.

DE&I

Providing financial care supports DEI initiatives across the board. In fact, financial wellbeing is so intertwined with these issues, implementing a DEI strategy that doesn’t include holistic financial care solutions will struggle to make any impact at all.

How Brightside Works

Client Stories

After a breakup, Bailey was left with debt and struggling to cover her bills. Learn how Brightside helped her manage the debt to save over $20,000 in interest and fees, and build a savings safety net.

When Chris suddenly became the sole income provider, he struggled to cover household bills, afford food, and manage credit card debt. Learn how Brightside helped him find support and much-needed relief.

When Rhetta’s adult daughter and roommate lost her job, they fell behind on bills. Learn how Brightside helped Rhetta navigate her employer’s hardship fund and get back on her feet.

Scott owed thousands of dollars in back rent payments and feared he’d lose his job without a place to live. Learn how his Brightside Financial Assistant helped him secure housing assistance to avoid eviction, cover his next three months of rent payments, and regain his financial footing.

Kendrick was struggling with more than $175,000 in debt. He came to Brightside because he needed more than just advice for how to manage his money; he needed solutions. Learn how his Financial Assistant helped him save more than $156,000 in interest and fees, and find a sense of relief …

Sandra was a single mom. One of her children was often sick and had asthma. She herself had a respiratory issue and had recently injured her wrist. She was also recently sued for $4,800 for a car she was renting and was stressed about past due medical bills and keeping …

Carmen and her husband were saving up $6,000 for their son’s immigration costs but Carmen had trouble sticking to a savings plan. She admitted to having a spending problem and used shopping as a way to cope with anxiety. She had taken on a part time job to pay down …

Learn how Brightside worked with Chris on a plan to restructure his debt and create a $500 savings cushion with a Brightside savings account, which allowed him to stay at his current employer.

Employer Resources

The traditional four pillars approach to employee wellbeing has the right elements, but they’re not all equal. Investing in financial health should be the top priority, or efforts to deliver physical, mental and social well-being will fall short.

Tom Spann is no stranger to helping people tackle financial challenges without judgment. He founded Accolade in 2007 to help working Americans navigate their health benefits, then moved on to co-found employee financial wellness company Brightside in 2017. He did so to shed light on what he sees as a …

Daniel Bryant, author of “The Financial Wellness Mandate” and Tom Spann Co-Founder and CEO of Brightside discuss the impact employee financial health has on employers.

This panel explored the disparities in access to financial services and explain why companies that want to enjoy the benefits of a truly diverse and inclusive workforce must provide access to holistic financial health benefits. It also explained why those services have to extend beyond retirement accounts and other tools …

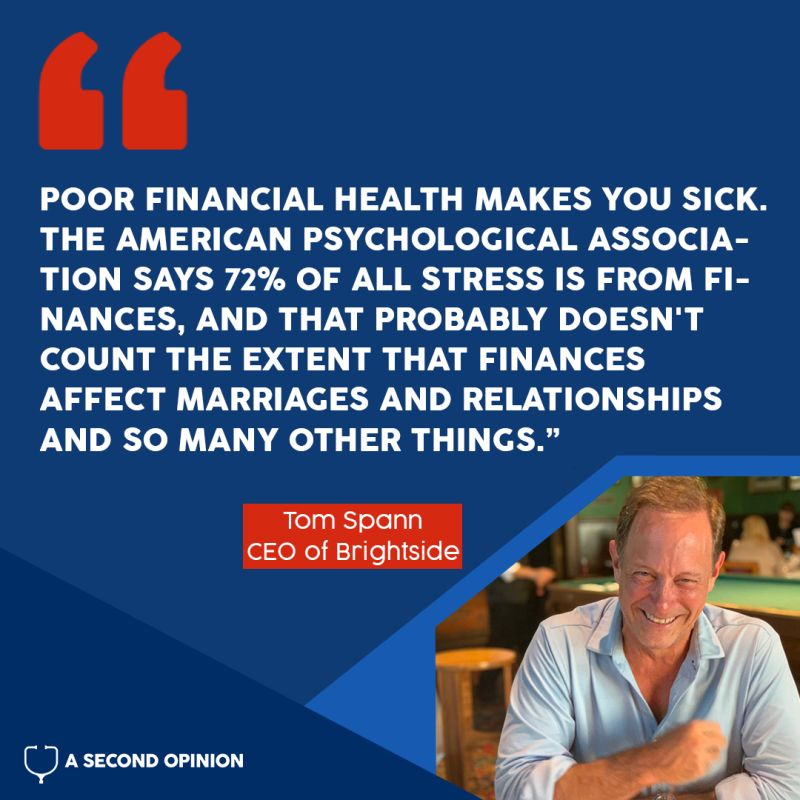

Poor financial health makes you sick. Brightside CEO Tom Spann shares the alarming and compelling connection between financial stress and long-term health outcomes, with differences in wealth connected to as much as a 15-year difference in longevity.

This tool lets you see the impact turnover has on your organization.

Financial stress is responsible for as much as 30% of employer healthcare costs. Gain a better understanding of how financial stress is impacting healthcare costs at your organization.

You can’t talk about one without the other: The case for including financial care within benefits packages to effectively address DEI.

Read our one-pager to see how financial care affects retention.

Read a study on financial care and stress amid the Great Resignation.