Tackling Credit Card Debt with Brightside

Americans hold a collective $820 billion in credit card debt spread across 505 million cards! So, when you look at your credit card bills, remember: You. Are. Not. Alone. In fact, one of the most common questions we receive at Brightside is, “Can you help me with my credit cards?” Yes, we can!

Brightside’s new Card Crusher feature helps you set a repayment plan, track your progress, and eliminate debt. It’s a simple and automated approach to the three-step method of tackling credit card debt.

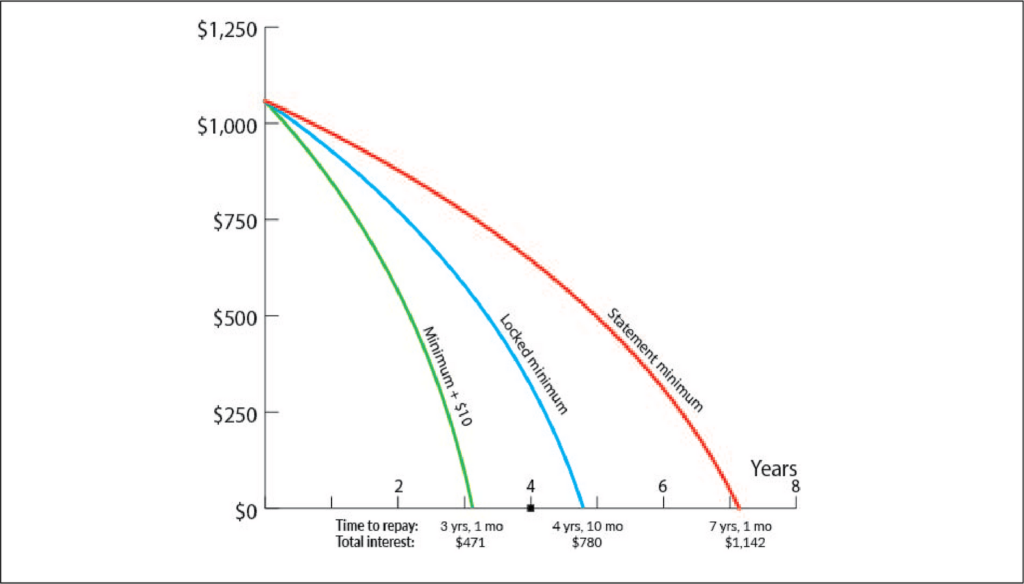

Credit Card Balance Payoff

Average credit card debt among Brightside clients is $1,070. The chart above shows payment timelines and total interest a person with that much card debt would face for each of the three plans described below. Adding $10 to a locked minimum payment cuts both timeline and interest by more than half!

Step 1: Pick a card

Research indicates the most effective way to pay down your cards is to start with the one with the lowest balance. But that’s on average. Work with your FA to figure out the best approach for you.

Step 2: Choose a plan

Your FA can help you explore the pluses and minuses of the three simplest options:

- Pay the statement minimum: This strategy will result in the lowest monthly payments but also the longest repayment timeline, as you will largely be paying interest.

- Lock in the minimum: Whatever the statement minimum is today, lock that in. For example, if the statement minimum is $50, pay $50 every month until you’ve crushed the debt. This can cut years off your repayment timeline.

- Add a bit extra: Locking the minimum is a great start, but adding a small extra amount, like $10 per month, will shred your repayment timeline. Just look at the chart above!

Step 3: Stop using the card

You need to stop using the card if you want to eliminate your debt. Lock it in a closet. Throw it in the freezer. Do what you must. Just avoid using it.And that’s it! And remember, you’ve got Brightside on your side to help with all this. In addition to the in-app tools, you have access to a Brightside Financial Assistant who does this for a living. All it takes is a short conversation and you’ll be on your way in no time.Need more support? Your Brightside FA is ready to get the conversation going as soon as you are.