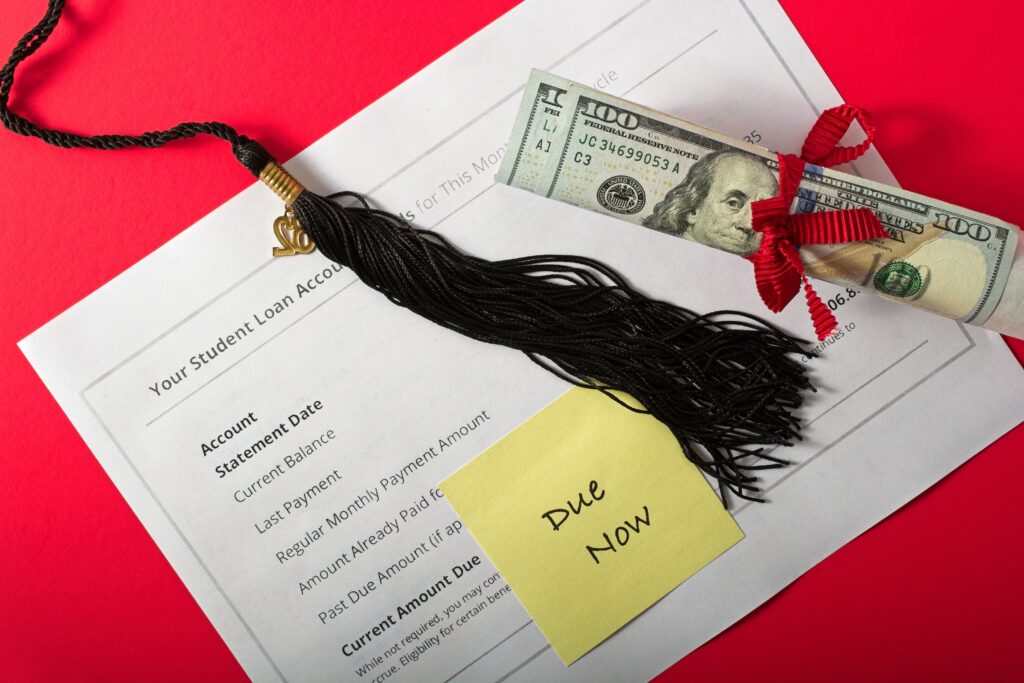

For years, student loans were paused. Conversations around them went quiet. But now that repayments resumed — and student loan collections have restarted — the financial impact of student loans is hitting employees and their employers hard. Not only have shifting policies left more than 43 million Americans who owe over $1.6 trillion in student debt confused about how to navigate significant student loan changes that could impact their financial lives, but nearly 10 million borrowers are in default or at risk of default. This isn’t just an employee issue; it has a direct impact on employers.

The unseen business risk of student loan default

The U.S. Department of Education initially announced that collections on student loans in default would resume May 5, 2025. On June 24, 2025, the Wall Street Journal reported that about two million borrowers could see their wages garnished by up to 15% this summer.

Not only could this send the 70% of employees who are already living paycheck to paycheck into severe financial distress if they’re impacted, wage garnishments are a problem employers have to manage.

For example, wage garnishments can introduce:

- Time-consuming payroll adjustments

- Legal risk from processing errors

- Morale issues as employees deal with reduced take-home pay

- Higher turnover as financially stressed workers seek new employment, even for a nominal pay change

Some employers offer student loan benefit point solutions, but most of these don’t consider the borrower’s holistic financial situation. As a result, they’re missing critical information that’s required to help employees make choices that support their best financial interests.

For example, if an employee has high-interest debt and loans, and is struggling to keep up with rent, childcare, and everyday needs, the optimal student loan repayment path for that borrower looks very different from that for a financially healthy employee.

Likewise, there may be opportunities to alleviate the employees’ surrounding financial struggles by helping them manage debt, save money on interest, and potentially secure free resources to offset the costs of housing, childcare, or utilities. A student loan point solution won’t offer that type of assistance; it’s not meant to and is not incentivized to do so.

How Brightside helps employees navigate student loans

Brightside Financial Care doesn’t treat student loan debt in isolation. Instead, each Brightside user is paired with a dedicated Brightside Financial Assistant who helps them understand all of their options based on their full financial picture. This includes helping them:

- Navigate income-driven repayment options and potential paths to loan forgiveness

- Apply for loan rehabilitation if they’ve already defaulted

- Identify wage garnishment risks before they impact paychecks

Marvin reduced his student loan payment amounts with Brightside’s help

Marvin was struggling to make his $500 student loan payment each month while living paycheck to paycheck. Once a few money emergencies set him back financially, he worried he couldn’t keep up his student loan payments much longer. He’d applied several times to different programs in an attempt to lower or pause his payments, but was continually denied.

His Brightside Financial Assistant helped Marvin discover that he did in fact qualify for a student loan repayment plan that reduced his monthly student loan payment amount from $500 to $0.

With that burden lifted, Marvin meets regularly with his Brighside Financial Assistant to build his credit score and an emergency savings account.

Student loan distress doesn’t have to disrupt your workforce

Financial stress is the root cause of common HR challenges including lost productivity, absenteeism, and higher healthcare costs, and recent changes in student loan policies are impacting your employees’ financial lives.

When you offer a benefit they can trust for personalized, confidential, and comprehensive support and real solutions that address student loans as well as other financial needs, including hardship, they’re empowered to show up as their best selves at work.

Learn more about how Brightside can help you turn student loan debt from a threat into an opportunity for your employees and your bottom line.