The financial stress brought on by employee financial illness is a contributing factor to workplace safety issues, due in part to reduced cognitive performance and sleep disturbances. The risks associated with financial stress and sleepiness are dangerous and costly to employees and employers alike. Read on to learn why and how investing in improving employee financial health can positively impact workplace safety, support your employees, and even lead to lower healthcare costs.

The connection between financial illness, sleep, and workplace safety

Sleep deprivation increases the likelihood of a workplace accident by 70%, with the effects of fatigue often compared to the effects of alcohol, resulting in impaired judgment and poor performance.

In healthcare, sleep deprivation is considered a latent hazard and creates “an unsafe condition” that leads to increased medical error rates. A separate study focused on transport estimated that truck driver fatigue is a contributing factor in 30 – 40% of all heavy truck accidents.

Impaired motor skills, poor decision making, risk taking, poor memory and information processing, and falling asleep on the job were officially identified as major dangers associated with tired workers by the American Safety Council.

Finances are the main cause of stress for most workers

With 73% of Americans ranking finances as their top stressor, financial worries impact employees’ concentration and focus during work hours and interfere with sleep, further degrading health and resilience. People with financial anxiety are the worst sleepers. “The average functional level of any sleep-deprived individual is comparable to the 9th percentile of non-sleep deprived individuals,” according to Circadian.

However, when financial stress is reduced, people get better quality sleep, and when rested, are better able to handle all types of stress, creating a virtuous cycle.

Remediating foundational causes of stress and sleep loss is critical to improving productivity, safety, and customer satisfaction.

How Financial Care can reduce financial stress and sleep deprivation

Fortune 500 employers see how lowering stress can create more engaged and productive employees when they offer Brightside Financial Care.

To alleviate frontline employees’ financial stress, the root causes of their financial stress have to be addressed with personalized support, real solutions, and support from an empathetic person who can help them build the hope they need to take small steps that eventually add up and make their financial situations better.

That’s the approach Brightside Financial Assistants take, and why our Financial Care model improves employee financial health and reduces associated financial stress quickly. We see the results reflected in the words of our Brightside users, like Sadie.

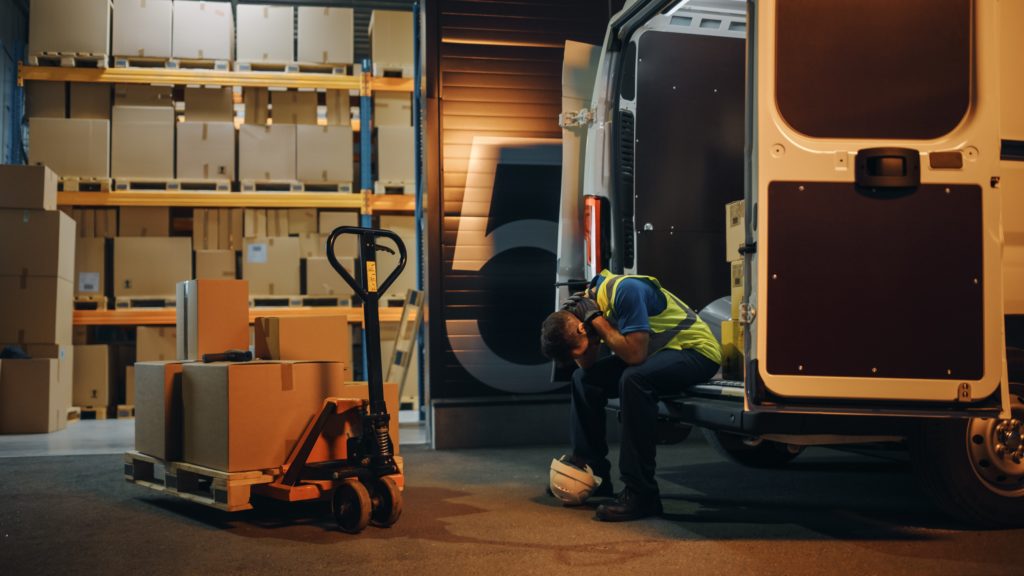

When Sadie came to Brightside, she told her Financial Assistant: “I’m just so tired.” Sadie worked in a distribution center and couldn’t afford to fix her car, which she needed to get to work. Life circumstances had left her with a maze of debts and she was overwhelmed. Her Financial Assistant helped Sadie get a safe employee loan to fix her car and pay off her high-interest debt. In parallel, her Financial Assistant helped her create a debt paydown plan and easy way to track how much money she has coming in and out. Sadie is now able to get to work without stress and told her Financial Assistant: “I couldn’t have done it without you. You helped me every step of the way.”

This article was originally published on November 1, 2021 and was updated for clarity.