Brightside vs. Traditional Financial Coaching: What’s the Difference?

Financial coaching has become a staple in many employee financial wellbeing strategies, with nearly half of employers surveyed by EBRI saying they offer it. Yet many employers don’t recognize that this model is only suited for a small fraction of their workforce – the 30% of employees who are financially healthy. Keep reading to learn why […]

Traditional Employee Financial Wellness Programs Are Failing. Here’s Why.

Every year, nearly $90 billion is invested in employee workplace wellness programs, according to Financial Health Network’s “Wellbeing in the Workplace” report. Yet, just 30% of employees are financially healthy – the lowest level seen since 2019. On top of that, the World Health Organization estimates that employee financial stress still costs employers around the […]

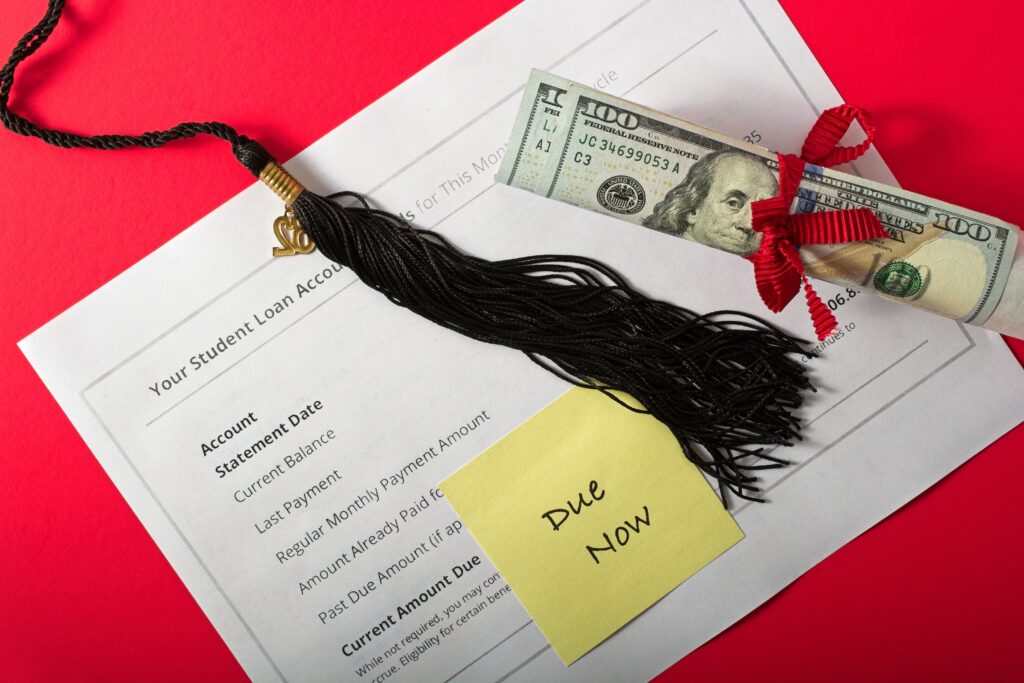

Why Student Loan Support Can’t Wait — And How Brightside Makes It Count

For years, student loans were paused. Conversations around them went quiet. But now that repayments resumed — and student loan collections have restarted — the financial impact of student loans is hitting employees and their employers hard. Not only have shifting policies left more than 43 million Americans who owe over $1.6 trillion in student […]

Is Your Employee Hardship Fund Worth the Headache?

Hardship funds are built with good intentions, but they often provide too little relief for the financially struggling while adding too much administrative burden for employers. Read on to explore the hard truth behind hardship funds, and how Brightside Financial Care changes that with an innovative approach that delivers meaningful impact for employees and employers. […]

Will a Benefit Really Alleviate Employees’ Financial Struggles? 7 Key Questions to Ask

More employers accept that employee financial stress isn’t an individual employee issue – it’s a business problem that drives higher turnover, absenteeism, and healthcare costs. Despite the sheer volume of traditional financial wellness and point solutions on the market, finding those that will address the needs of the 70% of employees who are not financially […]

Supporting Employees Through Crisis: How Brightside Makes a Difference

Natural disasters and unforeseen crises, like the ongoing California wildfires, leave employees facing immense uncertainty. Beyond the physical and emotional toll, many impacted employees find themselves navigating urgent financial needs, such as lost wages, unexpected major expenses, and how to replace lost and critical resources including housing and transportation. For HR leaders, these moments can […]

The Missing Piece in Wellbeing Benefits: Treatment for Financial Illness

Benefits leaders invest so much time, energy, and resources into selecting wellbeing benefits that help employees thrive, personally and professionally. Yet, more than 70% of employees are living paycheck to paycheck, and Americans are struggling with record levels of household debt. This means that many employees and, by extension, their employers, are facing a crisis […]

7 Signs Your Employees Are Not Financially Healthy

If you’re like 68% of benefits leaders recently surveyed by Mercer, you plan to support employees’ financial wellbeing in 2025. But to see a positive impact on employees’ financial lives and organizational ROI from the benefit, it’s critical that you first understand the financial challenges and barriers they need help overcoming. More than 70% of […]

Beyond Financial Wellness: Financial Care for Frontline Workers

If you’re using financial wellness benefits to support your frontline workers, are you seeing any improvements in their financial situations? Most employers don’t – but it’s not their fault. These benefits aren’t designed to address this financially vulnerable group’s financial struggles, let alone improve their financial health. Brightside CEO and Co-founder Tom Spann and Amazon […]

How is Brightside Financial Care Different from Financial Education?

Finances are the leading cause of employee stress, and it costs both employees and employers. While financial illiteracy can contribute to financial stress, it isn’t the only issue at play – and it’s not the root cause. In fact, research shows that one-size-fits-all financial education only correlates to a 0.1% in behavior change. To be […]