More than one-third of Americans have a subprime credit score, with an average FICO score of 578. The average subprime borrower has an annual income of about $68,000 and about $55,000 in total debt. Since the Federal Reserve began increasing interest rates in March 2022, Americans with low credit scores have had a tough time accessing credit: 82% who were denied credit or a loan said their financial lives were negatively impacted.

Employees who cannot access the financial help they need are at higher risk for absenteeism and reduced work performance. They experience greater difficulty with unexpected and uncontrollable events, such as a car breaking down. Many ignore or postpone healthcare needs to avoid additional medical bills. This can further contribute to absenteeism, reduced productivity, turnover, and increased healthcare costs for employers.

How improved credit scores reduce employee financial stress

Employers can help employees who are suffering from the financial strain that results from a low credit score by offering benefits that help struggling employees triage their immediate financial challenges and take steps to improve their basic financial health, including building their credit score.

Brightside Financial Assistants work with employees to help them navigate all things money — including credit scores. We closely monitor how we reduce financial stress by improving access to credit, and in turn, improve employees’ ability to get to work and be productive.

Study: The correlation between credit scores and workforce impact

From December 2019 through June 2020, credit scores of 4,855 employees at one corporation were tracked through credit reporting, to measure the impact of Brightside Financial Care services used by individuals who engaged with Brightside, compared to those who did not.

Employees who worked with a Brightside Financial Assistant in this seven- month period focused on a variety of activities to improve their financial health, including:

- Steps to solve short-term money needs

- Consolidate debt

- Examine spending habits

- Start savings plans

All of these steps positively impacted their credit scores.

What the data surrounding the impact of Brightside shows

At the beginning of the research period, 93% of employees seeking help from Brightside had subprime credit scores.

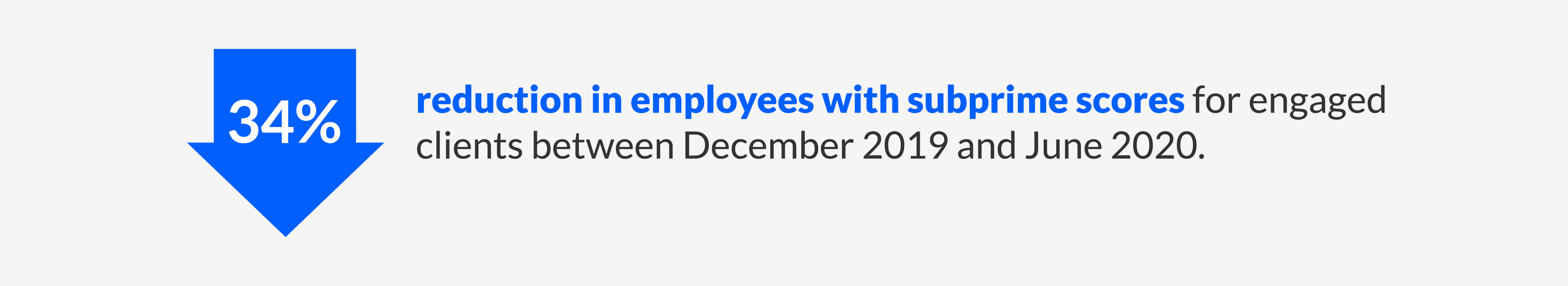

By the end of the seven-month period, only 61% of Brightside clients still had subprime credit, a reduction of 32 percentage points, or a 34% difference between December 2019 and June 2020. (You can download the full Brightside impact study here).

Additional financial health improvements underlying these improved credit scores included:

- Paying down credit cards: Brightside clients paid down credit cards three times faster than their non-engaged co-workers.

- Reduction in debt in collections: Brightside clients paid down debt in collections at nearly five times the rate of non-users.

These improvements contributed to the credit score improvements noted above, and are indicators of increased stability and financial health in their own right.

How Brightside can benefit employers and employees

As the study on employer-sponsored financial planning shows, working with a Brightside Financial Assistant has real impact in moving individuals’ credit above subprime levels.

When employees’ credit is no longer classified as subprime, they are less likely to be denied credit and better positioned to access non-predatory loans offered at favorable interest rates. This ultimately reduces the likelihood that financial instability will negatively impact absenteeism, turnover, and healthcare costs due to avoidance or delay of necessary care.

Employees with more financial freedom and reduced financial stress translates to a better life at work and at home.

Learn more about how Brightside helps employers deliver these benefits for their teams.