Across the country, employees are under enormous financial strain. As Jennifer Tescher, founder and CEO of the Financial Health Network, explained in Forbes: “More than half of Americans spent as much as or more than their income over the past year, and nearly a third of households reported falling behind on at least one bill payment.”

In this environment, even small setbacks such as a car repair, a lost shift, or an unplanned medical bill can push employees into crisis. And with the cap on overdraft fees repealed this past spring, it’s even more likely that financially struggling employees will get hit with some type of banking-related charge, whether it’s for overdrawing an account, not maintaining a minimum balance, or not meeting specific requirements to avoid an account service fee.

For a financially healthy employee, those fees are an annoyance. For the 70% of employees who are not financially healthy, they can quickly add up to financial disaster.

Employers can help by providing employees with access to free and affordable solutions that help them spend, save, and borrow safely – but it requires thinking beyond traditional financial wellness benefits.

Read on to learn about a few of the financial tools that Brightside Financial Care includes, and why they’re a key part of helping employees improve their financial health.

Access to safe financial tools is imperative

Many financial products are designed to generate a profit, often at the expense of people who are already financially ill. Employers that offer comprehensive financial support that includes safe financial tools employees cannot access on their own have a unique opportunity to help financially vulnerable employees succeed in a financial system that often works against them.

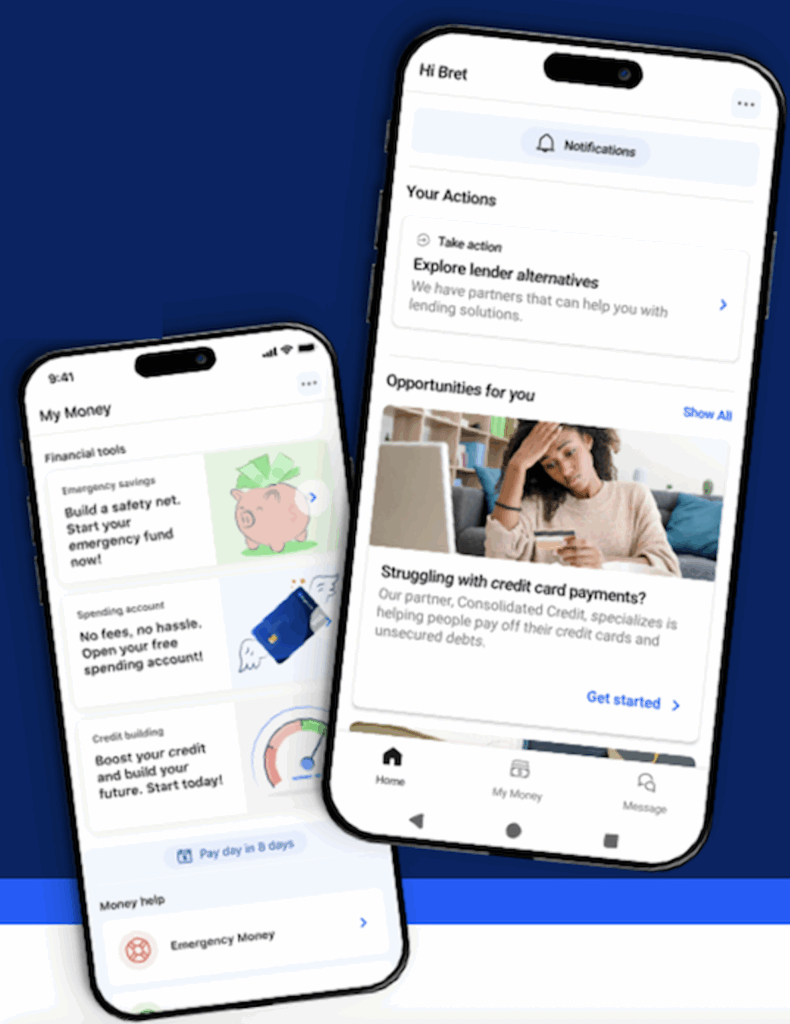

That’s why Brightside Financial Care offers employees access to a platform of carefully vetted financial tools that includes:

- Free Brightside Spending Accounts – No fees or minimum balance required. With direct deposit, employees can also access their paychecks up to two days early. If they need emergency money, they can access a $100 cash advance (also with no fees or penalties) that includes built-in guardrails to prevent the unhealthy debt cycles that commonly occur with earned wage access solutions.

- Free Brightside Savings Accounts– A paycheck-linked savings account that helps employees autosave as little as $1 directly from each paycheck. Funds in the account earn a market-leading rate, and each month, 50 autosavers are entered to win $100 to help build their savings account balance.

- Paycheck-linked loans – Available to employees who meet certain tenure requirements, regardless of credit score, these safe employee loans also include guardrails to prevent unhealthy borrowing and ensure that employees cannot enter into a monthly payment amount or terms that aren’t aligned with their financial reality. Payments are automatically deducted from their paycheck, which empowers them to borrow at affordable rates and terms they are unlikely to find on the open market. Whenever possible, Brightside Financial Assistants work to connect employees with free resources like employer hardship funds or government or local assistance programs so they can avoid borrowing entirely.

- Free credit-building tools – Employees can improve their credit scores with free tools that reward actions such as paying rent on time. They can also link their credit report in the Brightside app and receive personalized support from their Financial Assistant who will help them understand what’s driving their credit score, and actionable steps they can take to improve it. Employees also get free access to monitor their credit score anytime in the Brightside app.

- Debt management support – Employees can access low-cost debt consolidation options, free custom debt paydown plans, and free support handling bills or debt in collections. Depending on the specific situation and the employee’s needs and goals, these solutions help Brightside users pay down debt faster, access lower monthly payments, and often result in savings of thousands of dollars – which is much-needed money put back into their pockets.

- Student loan solutions – Personalized support navigating the changing maze of student loan repayment and forgiveness options, as well as help handling delinquent student loans or that have led to wage garnishment. Unlike one-off student loan benefits, Brightside considers the employees’ overall financial picture to help employees choose the best student loan repayment strategy for their unique financial situation.

Why this matters for employers

Providing employees with access to affordable financial tools is essential, especially for frontline employees carrying the heaviest financial burdens. Financial education, financial coaching, and access to a 401(k) can all help support employees – but they are not enough. When workers have safe, predictable, and affordable ways to spend, save, borrow, and repay, they’re empowered to overcome barriers and become more financially stable.

And the benefits don’t end with employees. Brightside’s Fortune 500 customers, including Amazon, and other large employers, see higher retention, lower healthcare costs, and improved productivity. This is all a result of thinking differently about supporting employees’ financial needs and investing in a financial wellbeing benefit that truly helps employees overcome their everyday money problems.

Schedule a demo to learn more about how Brightside Financial Care reduces employees’ financial stress and improves their financial health.